How to Earn, Track & Claim CPE Credits in 2025 – CPA Courses & More

Keeping up with professional education requirements can feel like a never-ending challenge. The deadlines, the confusion over what counts as valid credit, and the pressure to stay compliant—it’s enough to leave anyone feeling overwhelmed. If you’ve ever been stuck wondering where to find the right courses or how to balance this with everything else on your plate, you’re not alone. Many professionals share the same struggle, but here’s the good news: it doesn’t have to be this hard.

Continuing professional education credits are important for keeping your skills up-to-date and maintaining professional certifications. They help you grow in your career and stay ahead in your industry. This guide will show you the definition of CPE credits, why they matter, and how to earn them easily. Let’s make the process simple and stress-free for you.

What are CPE Credits?

What is CPE, and how can to earn CPE Credits? Continuing Professional Education CPE credits are units earned by professionals through various educational activities, such as courses, seminars, workshops, and conferences. These activities help professionals stay updated on the latest knowledge and skills in their field.

These units play a crucial role in maintaining professional certifications. Many certifying bodies require professionals to earn a certain number of credits to keep their certifications active. This ensures that professionals continue to learn and grow, meet industry standards, and stay competitive in the job market.

Professional education credits offer personal benefits in addition to maintaining certifications. They provide opportunities for networking with peers, enhancing job performance, and gaining new insights into industry trends. By participating in CPE activities, professionals can improve their expertise and increase their value to employers.

Just as RPG stats play a crucial role in defining a player’s progression and skill development, CPE credits help professionals level up in their careers, ensuring that they continue growing their expertise and meeting industry standards.

Who Needs CPE Credit?

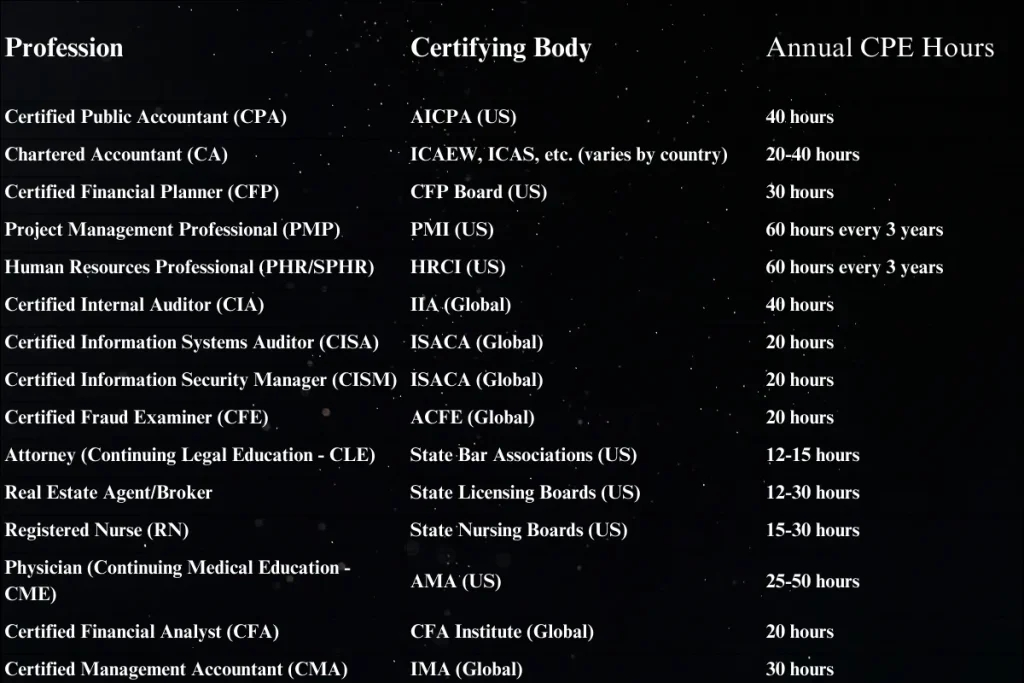

Many professions require continuing professional education credit to maintain certifications. Accountants, auditors, and financial planners are among them. These professionals must stay current with industry standards.

Continuing professional education credits are crucial in specific fields like IT and finance. IT professionals need to keep up with technological advancements. Finance professionals must stay informed about regulatory changes.

Earning credits ensures professionals remain competent. It helps them provide the best service to their clients. This ongoing education is essential for career growth.

Requirements to Earn and Maintain Educational Credits

To earn and maintain CPE credits, professionals must adhere to the guidelines established by their certifying bodies. These requirements help professionals stay updated with industry standards, maintain their degrees, and remain competitive in their fields.

General Requirements

Professionals can earn credits by participating in approved educational activities such as:

- Courses and Seminars: In-depth learning sessions on industry-specific topics.

- Webinars and Podcasts: Convenient options for remote education.

- Workshops and Conferences: Hands-on training and networking opportunities.

- Teaching or Publishing: Sharing knowledge through research presentations, teaching, or published work.

These activities ensure continuous professional growth and practical application of skills.

Field-Specific Requirements

IT Professionals

- Fulfill certification requirements by completing technical courses on cybersecurity, data management, or system design.

- Participate in hands-on labs or skill-based training sessions to enhance technical expertise.

Examples of IT Certifications That Mandate Continuing Education:

Several IT certifications mandate the earning of credits to maintain their validity, including:

- CISSP (Certified Information Systems Security Professional)

- CISM (Certified Information Security Manager)

- CompTIA Security+

Courses on networking technologies, including Cat5 and Cat6 cables, are essential for IT professionals. Understanding the differences, such as Cat5 vs Cat6, can greatly enhance technical knowledge.

The Importance of Continuing Education for IT Professionals

- Staying Updated: Continuous education ensures awareness of emerging technologies.

- Maintaining Expertise: Regular training keeps skills sharp and relevant.

- Career Growth: Earning these credits demonstrates a dedication to professional growth and career progression.

Finance Professionals

- Attend industry-specific seminars on topics such as federal tax regulations, financial planning, or compliance updates. For financial professionals, understanding state-specific regulations, such as California’s capital gains tax, is crucial.

- Participate in workshops focused on ethics and integrity in financial practices.

CPA CPE Courses Requirements

Certified Public Accountants (CPAs) must meet specific CPE requirements to retain their licenses. These include:

- Annual CPE Hours: Requirements typically range from 24 to 40 hours per year, depending on the state or region.

- Ethics Courses: Many jurisdictions require ethics training to maintain professional integrity.

- Jurisdictional Variations: Some states, like Florida, require 80 hours over two years, while others have annual requirements.

Example Table: CPA CPE Requirements

|

State/Region |

Annual CPE Hours Required |

Ethics Course Requirement |

|

California |

40 hours |

Yes (4 hours every 2 years) |

|

New York |

24 hours |

Yes (4 hours every 3 years) |

|

Texas |

40 hours |

Yes (4 hours annually) |

|

Florida |

80 hours (over 2 years) |

Yes (4 hours every 2 years) |

CPAs must understand these requirements to ensure compliance and maintain their credentials.

Healthcare Professionals

- Earn credits through courses on medical advancements, new treatment protocols, patient care strategies, and healthcare regulations.

These requirements allow healthcare professionals to stay informed about the latest developments and provide top-notch patient care.

By adhering to these field-specific guidelines, professionals in IT, finance, and healthcare can ensure their credentials remain valid, their skills remain current, and their careers continue to grow.

Importance of Credits

continuing professional education credits are not only a compliance requirement but also an integral part of a professional’s development and success in their industry.

Staying Current with Industry Trends

In industries like IT, finance, and healthcare, the rapid pace of change means that skills can become obsolete quickly. Professionals who fail to stay updated with the latest advancements and best practices risk falling behind, while consistently pursuing professional education ensures they stay at the forefront of their field.

Career Advancement and Opportunities

Earning credits helps professionals enhance their expertise and, as a result, their job performance. By acquiring knowledge that helps them better meet client needs, increase productivity, and adapt to new challenges, professionals position themselves for career advancement. In some industries, completing CPE activities can even open doors to promotions or new job opportunities.

Networking and Industry Involvement

CPE activities often provide opportunities for professionals to network with their peers, share knowledge, and collaborate on industry trends. Conferences, seminars, and workshops are excellent places to meet others in the same field, exchange ideas, and learn from shared experiences.

How to Earn and Claim Continuing Education Credits

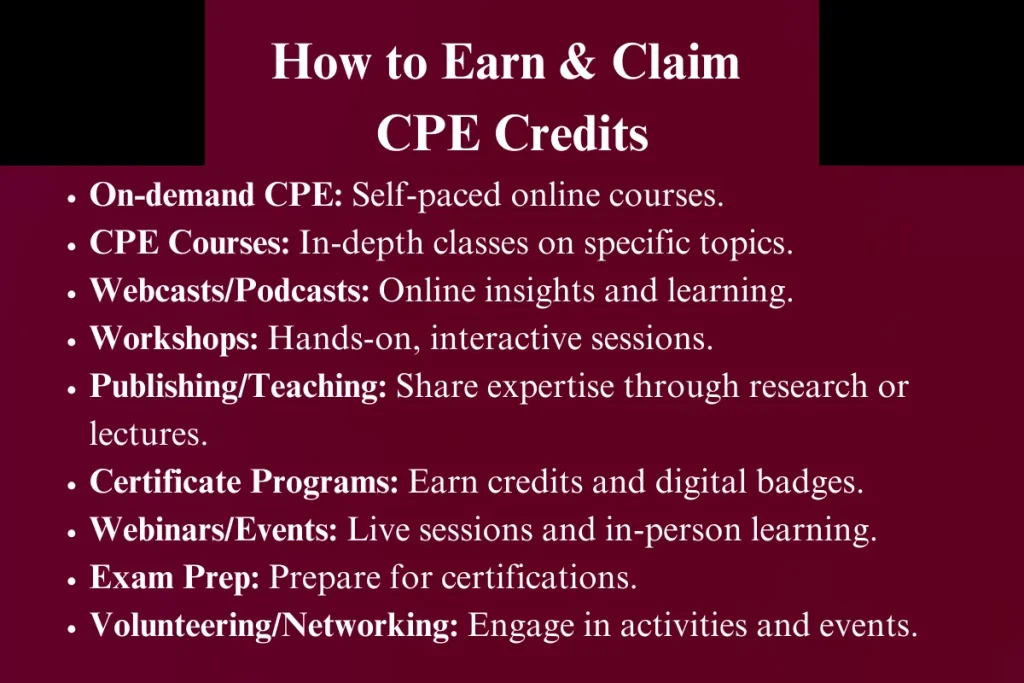

There are various methods to earn continuing educational credits. Here are the most common ones:

- On-demand CPE: Allows professionals to learn at their own pace through CPA online courses.

- CPE Courses: Structured hours of classes that offer in-depth knowledge on specific topics.

- Webcasts and Podcasts: Online broadcasts that provide valuable insights and information.

- Educational Workshops: Interactive sessions that offer hands-on learning experiences.

- Publishing Research: Writing and publishing articles, papers, or books.

- Teaching and Lecturing: Sharing expertise by teaching courses or giving lectures.

- Certificate Programs: Programs that offer both credits and a digital badge.

- Webinars: Live online sessions that cover various topics and provide credits.

- Events and Workshops: In-person events that offer networking and learning opportunities.

- Certificate Exam Prep: Preparing for certification exams can earn credits.

- Volunteering and Networking: Engaging in volunteer activities and networking events.

- Research and Publications: Conducting research and publishing findings.

These methods provide various opportunities to earn and claim professional education credits, ensuring professionals stay updated and maintain their certifications.

Tracking and Reporting CPE Credits

Professionals need to track their earned credits diligently. They can use digital tools, spreadsheets, or apps designed for tracking to depot their current credits. Keeping accurate records and hour calculations is crucial for maintaining certifications.

When it comes to reporting, professionals must submit their educational credits to relevant certifying bodies. This often involves filling out forms and providing evidence of completed activities. Timely and accurate reporting ensures compliance with certification requirements.

Methods to Track Credits

- Digital Tools: Use software designed to track your learning credits. e.g. Goodnotes

- Spreadsheets: Maintain a detailed spreadsheet of earned credits.

- Apps: Utilize mobile apps for on-the-go tracking.

Reporting Credits

- Fill Out Forms: Complete necessary reporting forms.

- Provide Evidence: Submit proof of completed CPE activities.

- Timely Submission: Ensure credits are reported within the required timeframe.

Proper tracking and reporting of continuing professional education credits are essential for maintaining professional certifications and ensuring continued growth.

Recent Trends and Updates in 2025 for CPE Credits

- Virtual Learning Growth: Many professionals now use CPA online courses and my CPE login portals for remote learning, offering flexibility to meet CPE certification requirements from home.

- AI-Powered Personalized Learning: AI is revolutionizing CPE education, tailoring courses to specific career needs, helping professionals stay relevant and competitive in their fields.

- Free CPE Resources: An increase in free CPE courses, such as free webinars, podcasts, and articles, provides professionals with cost-effective ways to earn credits.

- Digital Tools for Tracking: New digital tools and apps help professionals track and report their CPE credits easily, ensuring timely submissions to certifying bodies.

- Flexible Credit Categories: In 2025, professionals will have more options, including CPE solutions for specific industries like IT and finance, allowing them to choose relevant courses.

- Ongoing Emphasis on Ethics: Ethics training remains crucial for many professions, with CPA CPE courses and other programs focusing on compliance and ethical standards.

As we explore new trends in learning, the application of artificial intelligence is also becoming more prominent in fields like digital art. In fact, AI-driven techniques are now influencing various creative sectors, such as the world of AI art styles, where algorithms play a key role in transforming visual art.

Cost of CPE and Availability of Free Courses

Earning CPE credits often comes with costs. Professionals may need to pay for courses, webinars, and workshops. The typical cost can range from $50 to $500 per course, depending on the provider subscription and content.

However, free CPE courses are also available. Many organizations offer free webinars and online courses. These options can help professionals earn credits without spending much.

|

CPE Activity |

Cost Range |

|

On-demand CPE |

$50 – $300 |

|

Webinars |

Free – $200 |

|

Educational Workshops |

$100 – $500 |

|

Online Courses |

Free – $400 |

|

Publishing Research |

Varies |

|

Volunteering |

Usually Free |

Free resources include professional associations and online platforms. They often provide quality educational materials. This makes it easier for professionals to meet their CPE requirements affordably.

Meeting Ethics Requirements

Ethics in CPE are crucial for maintaining professional integrity. Professionals must adhere to ethical standards in their field. This ensures trust and credibility with clients and colleagues.

Different professions have specific ethics requirements. For example, accountants must follow the AICPA Code of Professional Conduct. IT professionals may need to comply with industry-specific ethical guidelines.

Meeting these ethics requirements often involves completing dedicated CPE courses. These courses cover topics like confidentiality, transparency, and professional behavior. Adhering to ethical standards helps professionals maintain their certifications and reputations.

Specific Ethics Requirements by Profession

|

Profession |

Ethics Requirements |

|

Accountants |

AICPA Code of Professional Conduct |

|

IT Professionals |

Industry-specific ethical guidelines |

|

Financial Planners |

CFP Board’s Code of Ethics and Standards |

|

Healthcare Workers |

HIPAA and other relevant regulations |

Ethics in continuing professional education credits reinforce a commitment to professional values and standards. They help ensure that professionals act responsibly and ethically in their roles.

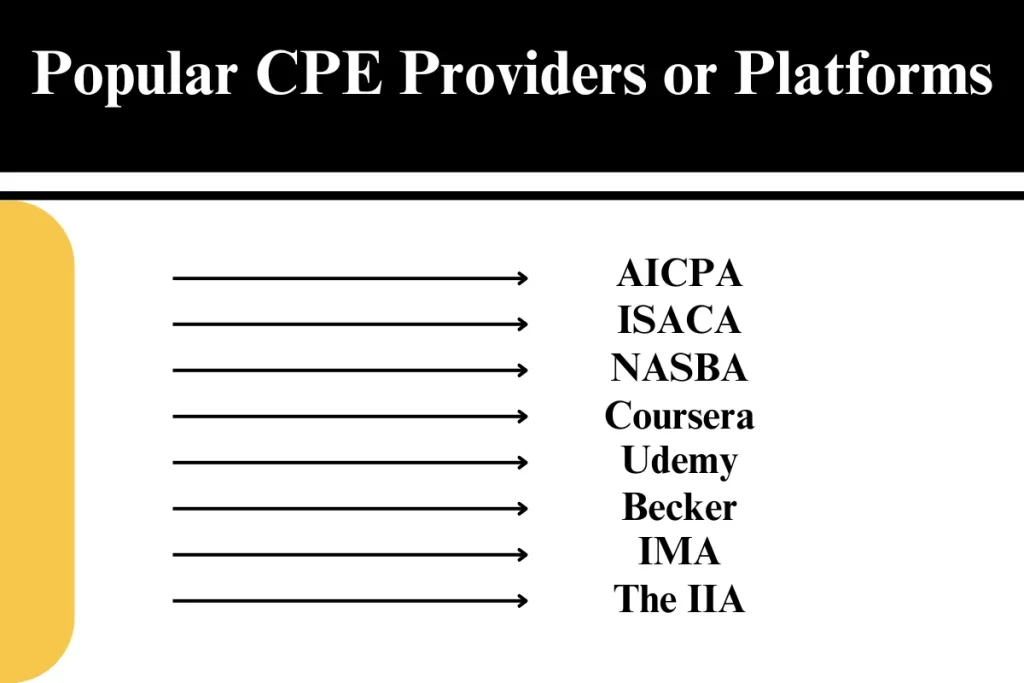

Providers of CPE Credits

Many organizations offer educational credits for professionals. These include industry associations, educational institutions, and online platforms. They provide various learning opportunities to help professionals stay current.

Popular Platforms and Providers

- AICPA: Offers a wide range of CPE courses for accountants.

- ISACA: Provides professional development units through conferences, webinars, and training programs.

- NASBA: Accredits CPE providers and approves quality education depending on requirements of the profession.

- Coursera: Online courses from top universities that offer learning credits.

- Udemy: Affordable courses covering a variety of topics.

- Becker: Specializes in CPE for accounting and finance professionals.

- IMA (Institute of Management Accountants): Offers learning credits through various learning programs.

- The IIA (Institute of Internal Auditors): Provides CPE opportunities for internal auditors.

These platforms and organizations offer diverse CPE opportunities. They help professionals maintain their certifications of proficiency and advance their careers.

Specific Opportunities from ISACA

- Conferences: Attend industry conferences organized by ISACA.

- Training Weeks: Participate in intensive training sessions.

- Online Training: Enroll in ISACA’s online training programs.

- ISACA Foundation Educational Events: Engage in educational activities hosted by the ISACA Foundation.

- On-demand Learning: Access ISACA’s on-demand learning resources.

- Journal Quizzes: Complete quizzes/tests based on articles in ISACA’s journals.

- Volunteering with ISACA and ISACA Foundation: Contribute your time and skills to ISACA and its foundation.

- Skills-based Training/Lab Activities: Participate in practical training sessions and lab activities.

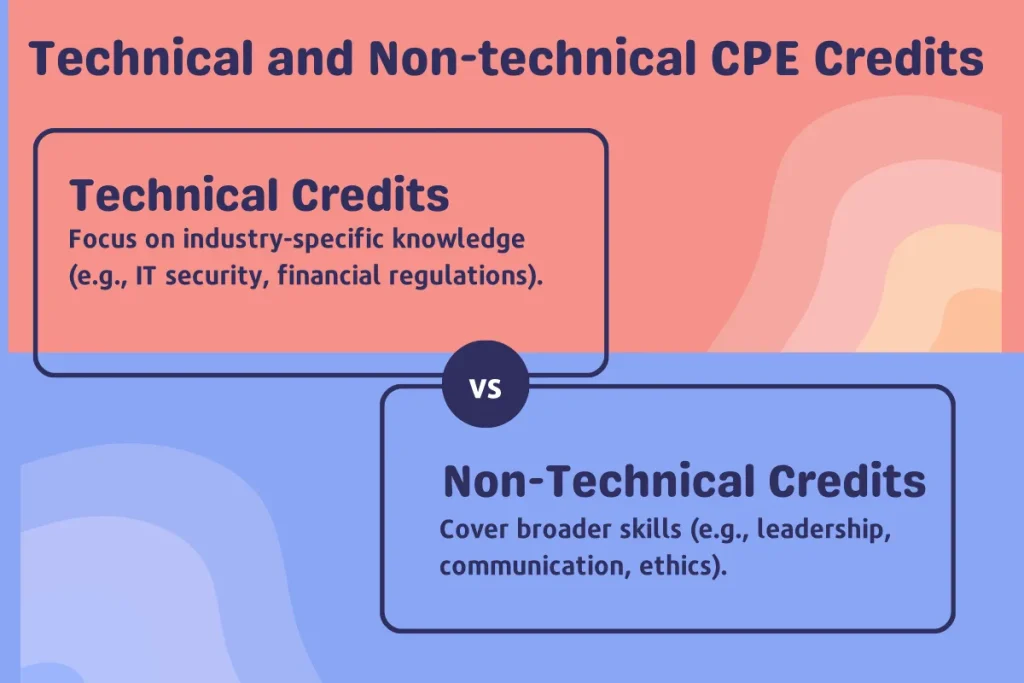

Technical and Non-technical Credits

Continuing professional educational credits can be categorized into technical and non-technical types. Technical credits focus on industry-specific knowledge. These include subjects like IT security, financial regulations, and advanced accounting principles.

Non-technical credits cover broader skills that are useful across various professions. They include topics like leadership, communication, and ethical practices. Both types of Educational credits are essential for well-rounded professional development. Marketing professionals can benefit from learning about concepts like channel marketing to enhance their strategic planning abilities.

Continuing professional education credit plays a vital role in professional development. They help individuals stay current with industry standards, enhance skills and knowledge, ensuring career growth.

Pursuing CPE credits is an investment in your future. It keeps you competitive and relevant in your field. By continuously learning, you can achieve long-term success and professional satisfaction.

FAQ’s:

How many hours is 1 CPE credit?

Typically, 1 CPE credit equals 50 minutes of participation in a qualified educational activity.

What does CPE stand for?

CPE stands for Continuing Professional Education

How do I claim my CPE credits?

You can claim your CPE credits by submitting them to the relevant certifying bodies. This usually involves filling out forms and providing evidence of completed activities.

How to calculate CPE credits?

CPE credits are calculated based on the duration of participation in educational activities. Generally, 50 minutes of instruction equals 1 CPE credit.