What is CPE Meaning? Continuing Professional Education Explained

In today’s fast-paced professional world, staying relevant can feel overwhelming. Whether you’re striving to advance in your career, meet industry-mandated certification requirements, or simply keep up with the latest trends, the pressure to continuously improve is real. Many professionals face the challenge of balancing their busy lives with the need to grow their skills and knowledge.

This is where continuing professional education CPE comes in. By offering a structured approach to learning, it helps professionals stay ahead in their fields, meet regulatory requirements, and unlock new growth opportunities. In the next sections, we’ll explore what CPE is and how it can transform your career.

What is Continuing Professional Education (CPE)?

What does CPE stand for? CPE stand for Continuing Professional Education and is essential for professionals in many fields. It involves ongoing learning to maintain and enhance one’s skills and knowledge. This ensures that professionals stay updated with the latest developments in their industry.

CPE is significant because it helps professionals keep their certifications active. It also improves their expertise and career prospects. Employers value employees who continue to learn and grow. This makes CPE a key component of professional development.

Key terms in CPE include:

- CPE hours: The time spent on educational activities.

- CPE credits: Units awarded for completing CPE activities.

- Compliance: Meeting the required standards for CPE.

- Qualifying programs: Educational activities that count towards CPE requirements.

- Certifying Bodies Organizations or authorities that mandate the earning of CPE credits to maintain professional certifications.

Benefits of CPE

Professional Growth

Continuing Professional Education helps enhance skills and knowledge, which leads to career advancement. It allows professionals to stay current with industry trends and best practices. Engaging in CPE shows a commitment to personal development and professional excellence.

Much like how self empowerment plays a vital role in personal growth, Continuing Professional Education (CPE) empowers professionals to take control of their career development and future success.

Networking Opportunities

CPE programs provide opportunities to connect with peers and industry leaders. Networking can lead to new collaborations, mentorship, and job opportunities. Building a strong professional network is invaluable for career growth.

Personal Development

CPE fosters lifelong learning and personal growth beyond professional skills. It encourages critical thinking, problem-solving, and adaptability. Engaging in continuous learning helps professionals stay motivated and passionate about their work. Explore how mastering High Ticket Sales can significantly impact your professional growth and career advancement.

The Impact of CPE on Professional Certification

What is a CPE certification? Continuing Professional Education is crucial for maintaining certifications. It ensures that professionals stay updated with industry changes and advancements. Completing CPE requirements helps in renewing certifications and adhering to industry standards. This continuous learning keeps professionals competitive in their fields and helps them provide the best services.

CPE plays a key role in career advancement. Professionals who engage in CPE are seen as more knowledgeable and skilled. This commitment to learning can lead to better job opportunities and promotions. Employers value employees who are dedicated to ongoing education and professional development. Engaging in CPE demonstrates a commitment to excellence and growth, which can enhance professional reputation and open up new career paths.

Standards for CPE Continuing Professional Education

Standards for CPE ensure that professionals maintain their skills and knowledge. They provide a framework for developing, presenting, and measuring CPE programs. These standards cover content, delivery, and assessment of CPE activities. This helps ensure that programs are relevant and effective.

Revised Standards Effective January 1, 2024, were approved by NASBA and AICPA. These updates offer clearer guidelines and classifications for CPE credits. The revised standards include specific requirements for instructors, materials, and learning methods. They emphasize interactive and practical learning.

Adhering to these standards is crucial for maintaining the quality of CPE programs. They ensure that professionals receive a high-quality education that meets industry requirements. Regular reviews and updates help keep pace with advancements. This ensures CPE remains relevant and beneficial.

The Role of NASBA and AICPA in CPE Governance

The National Association of State Boards of Accountancy (NASBA) oversees the governance of CPE. NASBA CPE Credits manages the National Registry of CPE Sponsors. This registry ensures that CPE providers meet specific standards. NASBA fields of study sets the requirements for CPE sponsors. This helps in maintaining the quality of education offered.

The American Institute of Certified Public Accountants (AICPA) works with NASBA CPE tracking to set standards. AICPA CPE requirements provides guidance and resources to CPAs. They offer various CPE courses to help professionals stay updated. AICPA ensures that the courses meet industry standards.

General CPE Requirements

Professionals must complete a certain number of CPE hours each year to maintain their certifications. These requirements vary by profession, so it’s crucial to check the specific guidelines for your field. Most certification bodies provide a detailed list of acceptable CPE activities. Staying updated with these requirements ensures compliance and professional growth.

How to offer CPE credits and who needs CPE credits? Not all programs qualify for CPE credits. Approved programs must meet specific standards set by governing bodies like NASBA and AICPA. They should be relevant to the professional’s field and provide substantial educational value. Programs can include courses, seminars, webinars, and workshops, each offering different forms of learning.

CPE Compliance and Documentation

Professionals must follow a clear process to ensure compliance with CPE requirements. This involves selecting approved programs and completing the required hours. Regularly reviewing the guidelines helps to stay compliant and avoid any penalties. It’s important to plan and track your CPE activities throughout the year to ensure you meet the requirements.

Keeping accurate records is crucial for CPE compliance. Professionals should document all CPE activities, including course details and completion dates. Evidence can include certificates, transcripts, and attendance records. These documents are necessary for verification, audits, and ensuring that all completed hours are properly accounted for.

Types of CPE Programs and Courses

CPE programs come in many forms, including courses, seminars, webinars, and workshops. They cover a wide range of topics aimed at enhancing professional skills and knowledge. Examples include “Effective Communication for Professionals” and “Advanced Financial Modeling.”

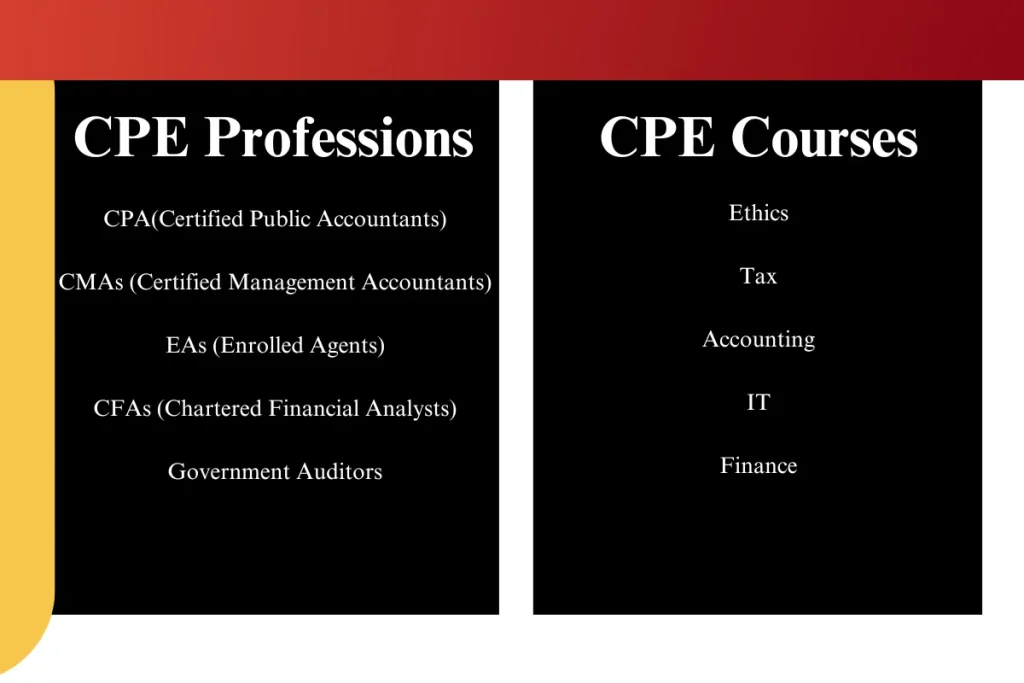

CPE for Different Professionals

CPE requirements are tailored to various professions to ensure relevant skills are maintained. Different fields need different focuses, from accounting to management to auditing. Completing these courses helps professionals stay compliant and advance in their careers.

CPAs (Certified Public Accountants)

What is CPE in accounting and how many CPE credits for CPA? Courses on accounting and auditing are essential for CPAs. Programs like “Fundamentals of Auditing” and “Financial Reporting Standards” help them stay compliant with industry regulations. Without CPE, they risk losing their certification and may face disciplinary actions.

CMAs (Certified Management Accountants)

CMAs focus on management accounting, strategic planning, and financial management. Courses such as “Strategic Financial Management” and “Budgeting Essentials” enhance their value to employers. Failure to complete CPE can lead to a loss of certification and hinder career growth.

EAs (Enrolled Agents)

EAs need tax-related courses to stay updated on tax laws and IRS regulations. Programs like “Federal Taxation Update” and “Advanced Tax Planning Strategies” are crucial. Without completing CPE, EAs may lose their certification and face challenges in their practice.

CFAs (Chartered Financial Analysts)

CFAs must stay updated on finance, investment strategies, and portfolio management. Courses such as “Equity Analysis” and “Portfolio Management Techniques” help them make informed investment decisions. Not completing CPE can result in losing their CFA designation and limit career opportunities.

Government Auditors

Government auditors benefit from courses on public sector auditing, compliance, and governmental accounting. Programs like “Governmental Accounting Standards” and “Public Sector Auditing Practices” ensure transparency in financial management. Not completing CPE requirements can impact their professional credibility and job performance.

Specific Courses Across Professions

Certain CPE courses are beneficial across multiple professions, covering ethics, tax, accounting, IT, and finance. These courses help professionals stay updated in essential areas. Enrolling ensures high-quality services and informed decisions.

Ethics

Ethics courses help professionals adhere to industry standards and maintain integrity. Examples include “Professional Ethics for Accountants” and “Ethical Decision Making in Finance.” Without ethics training, professionals may face ethical dilemmas and damage their reputations.

Tax

Tax courses keep tax professionals updated on regulations and tax planning strategies. Programs like “Tax Law Changes” and “Corporate Tax Strategies” are essential. Without CPE, tax professionals may miss important updates and risk legal issues. To understand specific regional tax implications, such as those in California, refer to our detailed guide on Capital Gains Tax California.

Accounting

Accounting and auditing courses are crucial for maintaining accuracy and compliance. Courses such as “Advanced Financial Accounting” and “Internal Auditing Techniques” help professionals stay updated with standards. Without CPE, accountants may fall behind in their knowledge and risk non-compliance.

IT

IT courses are important for tech professionals to stay current with technological advancements. Examples include “Cyber security Essentials” and “Cloud Computing for Businesses.” Without CPE, IT or computer professionals may struggle to keep up with rapid changes in technology.

Finance

Finance courses help professionals stay current with financial trends and investment strategies. Courses like “Financial Market Analysis” and “Investment Portfolio Management” provide insights into market developments. Without CPE, finance professionals may lack the knowledge needed to make informed decisions.

Technology and CPE

Online Learning:

The rise of digital platforms has made CPE more accessible and flexible. Online courses and webinars allow professionals to learn at their own pace. This flexibility is especially beneficial for those with busy schedules.

Virtual CPE Reality and Simulations:

Emerging technologies provide interactive and immersive learning experiences. Virtual reality and simulations can enhance understanding and retention of complex concepts. These technologies make learning more engaging and effective.

Mobile Learning:

Apps and mobile platforms allow professionals to engage in CPE on the go. Mobile learning provides convenience and flexibility, enabling learning anytime, anywhere. It helps professionals make the most of their time and stay updated. For an in-depth comparison of popular mobile learning tools, check out our comprehensive review of note-taking apps.

Tips for Maximizing CPE

Set Clear Goals:

Identify what you want to achieve through your CPE activities. Setting clear goals helps in selecting the most relevant programs. It ensures that your CPE efforts align with your career objectives.

Choose Relevant Programs:

Select programs that match your professional needs and interests. Relevant CPE programs provide practical knowledge and skills that can be applied in your work. They help you stay competitive and effective in your field.

Just as RPG stats help determine a character’s strengths and weaknesses, tracking your CPE credits helps measure your professional growth and progress toward career goals.

Stay Organized:

Keep track of your CPE activities, deadlines, and documentation. Staying organized helps in meeting CPE requirements and avoiding last-minute rush. Use digital tools or a personal log to monitor your progress and stay on track.

Choosing the Right CPE Provider

Choosing the right CPE provider is crucial for your professional growth. Look for providers with a strong reputation in your industry. Check if they are listed on the National Registry of CPE Sponsors, which ensures they meet high standards. Read reviews and ask colleagues for recommendations to get an idea of the provider’s quality. Verify the provider’s credentials and experience to ensure they are well-qualified.

Quality and relevance are key factors when selecting CPE programs. Choose programs that match your specific professional needs and goals. Ensure the content is up-to-date and relevant to current industry trends and practices. Look for courses that offer practical knowledge and skills that you can apply in your work. Check if the provider follows recognized standards and guidelines to guarantee the program’s quality.

Enrolling in a reputable CPE school that offers accredited programs can help you stay compliant while advancing your career. It’s essential to choose a CPE accreditation provider recognized by industry standards like NASBA to ensure the programs meet professional development requirements.

Future of Continuing Professional Education

The landscape of CPE is constantly evolving. Digital learning platforms are becoming more popular. Online courses and webinars offer flexibility and convenience. There is also a growing focus on interactive and practical learning. Gamification and real-world scenarios are being used more frequently.

Future standards will likely emphasize flexibility and accessibility. The aim is to make CPE more adaptable to different learning styles. Updated guidelines will focus on the quality of content. Revisions will ensure that CPE remains relevant to industry changes. Continuous feedback from professionals will help shape these standards.

Continuing Professional Education (CPE) is crucial for maintaining professional skills and certifications. It ensures that professionals stay current with industry changes. CPE also enhances career advancement opportunities and expertise.

It’s important to stay updated with CPE requirements to maintain your credentials. Regularly participating in CPE activities helps you stay competitive in your field. Invest in quality education to ensure your professional growth.

FAQ’s

What is the purpose of CPE?

The purpose of CPE is to ensure that professionals keep their certifications active and stay informed about the latest developments in their field. It helps in maintaining competence and advancing careers.

How to get a CPE certificate?

To get a CPE certificate, enroll in approved CPE programs. Complete the required courses and activities. Upon completion, you will receive a certificate from the CPE provider.

What is the difference between a CPA and a CPE accountant?

A CPA (Certified Public Accountant) is a licensed professional accountant. CPE (Continuing Professional Education) refers to the educational activities CPAs must undertake to maintain their certification. CPAs engage in CPE to stay updated and comply with professional requirements.

How to enroll in online continuing education programs?

To enroll in online continuing education programs, research and select a reputable CPE provider. Visit their website and register for the desired courses. Follow the enrollment process to start your learning journey.