Capital Gains Tax California 2025 | Avoid Tax on Real Estate with Exemptions & Tips

Dealing with taxes can be stressful. Many people find it hard to understand capital gains tax California and worry about unexpected tax bills.

This guide will help you navigate these complexities. You will learn about the latest updates, rates, and strategies to reduce your tax burden in 2025.

Basics of Capital Gains Tax California

Capital gains are the profits you make when you sell an asset for more than you paid for it. These gains can be taxed differently depending on how long you hold the asset in California.

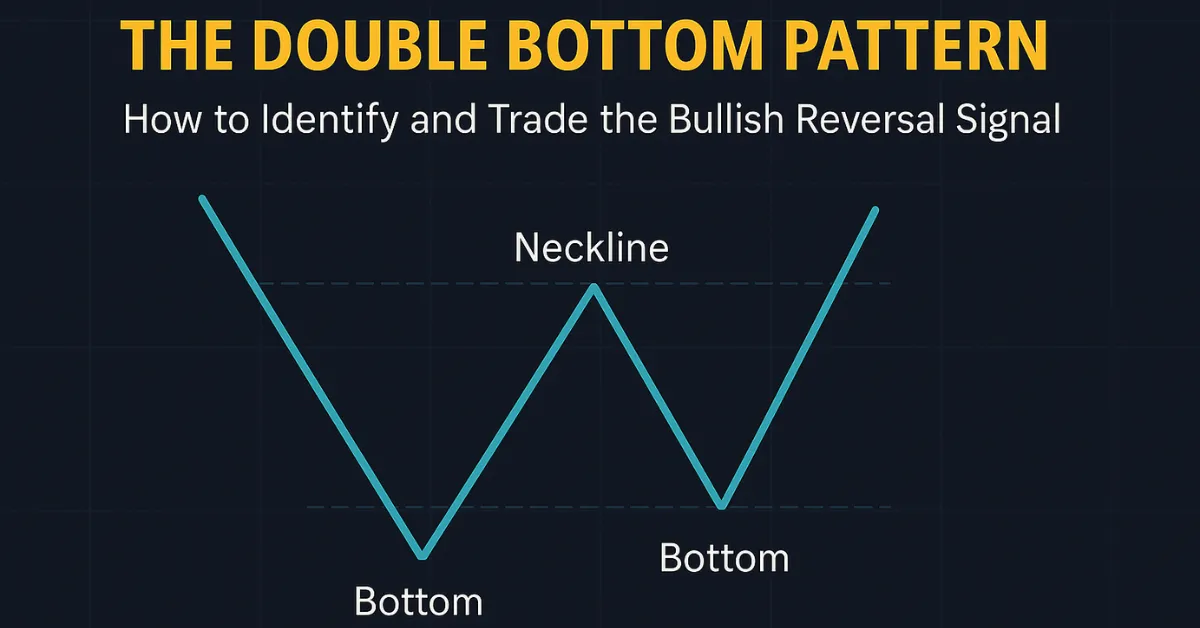

Short Term vs Long Term Capital Gains

Short-Term Capital Gains

Short-term capital gains apply to assets held for one year or less. In California, these gains are taxed at the same rate as your regular income. This means they can be quite high, depending on your tax bracket.

Long-Term Capital Gains

Long-term capital gains apply to assets held for more than one year. These gains are usually taxed at lower rates compared to short-term gains. Understanding this difference helps in planning your investments to minimize tax liabilities.

Capital Gains Tax: Understanding Assets and Their Impact

What Are Assets and How Are They Taxed?

Understanding what are assets is crucial when considering capital gains tax. Whether it’s real stock, land stock, or cero stock, assets definition plays a central role in tax calculations. Realizing gains from these assets involves considering asset meaning, including potential loss or gain stock.

Factors of 28 and 28+28 illustrate how multiple assets can be handled in a portfolio, showing how assets examples help in calculating your capital gains tax.

Short-Term vs Long-Term Capital Gains on Assets

Long term assets are taxed at lower rates, while short-term investments are taxed as regular income. Knowing the difference between marginal cost and marginal revenue helps optimize your tax strategy based on the net stock or low stock holdings you may have.

Recent Updates to Capital Gains Tax in California

Proposed Elimination of Capital Gains Tax on Home Sales

In recent discussions, former President Donald Trump has proposed eliminating capital gains tax on home sales to encourage market activity. This proposal, if implemented, could allow homeowners to exclude up to $500,000 in capital gains from the sale of their primary residence (for married couples). This change could significantly benefit California homeowners, where property values have appreciated considerably. The proposal aims to reduce taxing burdens and increase housing market inventory.

Increased Capital Gains Realizations for 2025

California’s 2025-26 Governor’s Budget Summary reveals an upward revision in capital gains realizations. Due to the ongoing growth in the stock market and stronger-than-expected personal income tax receipts, California projects a 20% increase in capital gains realizations for 2024, with an additional 15% increase in 2025. These increases could result in a substantial rise in the overall tax revenue, potentially influencing future tax policy.

Primary Residence Exclusion Under Scrutiny

The existing primary residence exclusion limits, which allow single homeowners to exclude $250,000 and married homeowners to exclude $500,000 of capital gains from the sale of their homes, have remained unchanged since 1997. Given the significant rise in home values across California, particularly in areas like the San Francisco Bay Area, some lawmakers are pushing to increase these limits or eliminate them entirely. If passed, this change could benefit homeowners with significant realized gains when selling their primary homes.

Qualified Small Business Stock (QSBS) Exemption

Currently, California does not conform to the federal Qualified Small Business Stock (QSBS) exemption under IRC Section 1202. While the federal government allows for the exclusion of capital gains from the sale of QSBS, California taxes these gains as ordinary income. This tax treatment can have significant implications for California residents who hold QSBS, as they do not benefit from the federal exemption.

Inflation Adjustments for Federal Capital Gains Tax Rates

The IRS has announced inflation adjustments for capital gains tax brackets for 2025. These adjustments impact taxpayers’ eligibility for different capital gains tax rates. For example, single filers can qualify for the 0% long-term capital gains tax rate if their taxable income is up to $48,350, and married couples filing jointly can benefit if their taxable income is up to $96,700. These updates are crucial for tax planning, as they could reduce the capital gains tax liability for many taxpayers in California.

One major update is the adjustment of income thresholds for capital gains tax rates due to inflation, which can impact financial risks and the probability of default for certain investors. This means slight increases in the income limits for different tax brackets.

California Capital Gains Tax Rates

Current Rates

California has different cap rates for short-term and long-term capital gains.

|

Income Bracket |

Short-Term Rate |

Long-Term Rate |

|

Low Income |

1% |

0% |

|

Middle Income |

9.3% |

5.8% |

|

High Income |

12.3% |

9.3% |

Rates Comparison for 2025

In 2025, the tax rates have been adjusted slightly to account for inflation and economic changes. It is crucial to stay informed about these updates to ensure accurate tax planning.

|

Year |

Income Bracket |

Short-Term Rate |

Long-Term Rate |

|

2025 |

Low Income |

1.1% |

0.1% |

|

2025 |

Middle Income |

9.4% |

5.9% |

|

2025 |

High Income |

12.4% |

9.4% |

Just like the transition from DDR6 to newer, faster memory improves performance, staying updated on the latest capital gains tax rates in California helps optimize your financial strategy for maximum tax efficiency.

Federal Capital Gains Tax Rates

How Federal Rates Interact with California Rates

The federal tax rates depend on your income and the time you held the asset. When combined with California capital gains tax, these rates can significantly impact your overall tax burden.

Federal Short-Term and Long-Term Rates for 2025

Here are the federal capital gains tax rates for 2025:

|

Year |

Income Bracket |

Short-Term Rate |

Long-Term Rate |

|

2025 |

Low Income |

10% |

0% |

|

2025 |

Middle Income |

22% |

15% |

|

2025 |

High Income |

37% |

20% |

Exemptions and Deductions

Primary Residence Exclusion

One of the most significant exemptions available is the personal residence exclusion. However, if you own a second home, different rules may apply for capital gains tax. You may be eligible to exclude up to $250,000 of capital gains if you sell your primary home and single.

$500,000 if you’re married and filing jointly. This is known as the section 121 exclusion.

You must have owned and lived in the home for at least two of the five years before the sale to qualify. Sale of home exclusion can significantly reduce your taxable income.

The primary residence exclusion can help homeowners reduce their capital gains tax. If you’re under the top 1 percent income bracket, you might benefit from 20% of 1500 in savings. Special provisions for seniors provide a one-time exemption on capital gains from home sales.

Special Exemptions for Seniors

California offers a one-time exemption for seniors. If you’re 55 or older, you may qualify for a one-time exclusion on the capital gains from the sale of your primary residence.

This exemption is designed to help seniors transition to new living arrangements without facing a large tax burden. It is important to note that this exemption can only be used once in a lifetime.

Guidelines from Pub 523 IRS

The IRS provides detailed guidelines in Publication 523 on how to report the sale of your home. The publication 523 Selling Your Home outlines the criteria for exclusions, how to calculate your gain, and the necessary forms to file.

It’s a crucial resource for anyone looking to understand their obligations and maximize their benefits when selling a primary residence.

What Is the Highest Number of Assets to Include for Exemption?

When calculating your exemptions, the IRS defines limits such as the maximum exclusion amount. Use 28 factors to identify which assets qualify and how to calculate those exemptions. This includes the difference threshold that helps you determine if you’re eligible for reduced rates.

Selling Property: Regulations and Requirements

California vs. Federal Regulations

It is essential to understand the difference between California and federal regulations when selling property. California has its own set of rules that may differ from federal guidelines.

Knowing these distinctions can help you avoid potential pitfalls and ensure compliance with both state and federal laws.

Ownership and Use Requirements

You must meet specific ownership and use requirements to qualify for certain exclusions.

As mentioned earlier, the primary residence exclusion allows you to exclude capital gains. If you’re single, you can exclude up to 250,000. If you’re married and filing jointly, you can exclude up to 500,000.

Rules for Single and Married Taxpayers

California offers different rules for single and married taxpayers regarding capital gains tax.

|

Taxpayer Status |

Requirements |

Exclusion Amount |

|

Single |

Owned and lived in the home for 2 out of 5 years |

$250,000 |

|

Married |

Owned and lived in the home for 2 out of 5 years |

$500,000 |

Understanding the Capital Gains Tax Calculation Process

Calculating Capital Gains on Property Sales

What is a capital gain and how do you calculate it? This section explains how to assess your asset from the sale of a property and apply it towards capital gains tax in California. If you’re looking to sell and calculate gains from your principal residence, using a real estate calculator can simplify the process.

For instance, when determining asset meaning, it helps to know that the capital gains tax on home sale is impacted by the 20% of 3000 value from property sales.

Using Calculators for Long-Term and Short-Term Gains

Use a calculator to determine how your long-term investments can be taxed at preferential rates versus your short-term investments taxed at ordinary income rates. This is especially relevant for top 1 percent income earners who may face higher rates of tax.

How to Calculate Capital Gains Tax in California

Calculating capital gains tax California involves a few key steps.

- Determine the original purchase price of the asset.

- Add any costs associated with improvements made to the asset.

- Subtract the total amount of any depreciation claimed during ownership.

- Calculate the sale price of the asset.

- Subtract the adjusted basis (original purchase price plus improvements minus depreciation) from the sale price to determine your capital gain.

- Identify whether the gain is short-term or long-term based on the holding period.

- Apply the appropriate tax rate based on your income bracket and the type of gain (short-term or long-term).

Strategies to Minimize Capital Gains Tax

Here are some strategies to help minimize your tax liability:

- Hold onto investments for more than a year to qualify for long-term capital gains rates. These are generally lower than short-term rates.

- Invest in tax-deferred retirement accounts like IRAs or 401(k)s. This allows your investments to grow tax-free until you withdraw them.

- Offset gains with losses by selling underperforming assets. This practice is known as tax-loss harvesting.

Efficient Investments and Netting Losses

Efficient investments such as long-term investments and tax-deferred accounts like IRAs can help minimize tax burdens. Netting involves offsetting realized losses to reduce net cost of your gains, especially when dealing with underperforming stocks.

Consider 20% of 15 or 20%(15/20) of 28 calculations to evaluate how much of your investment portfolio can be offset.

Progressive Work From Home Strategies

With more flexibility in work schedules, investments can be adjusted for progressive stock buying and selling. Whether you are holding onto my stocks or using tax-efficient investments, understanding how to roll your RS (restricted stock) can help increase your long-term wealth and reduce taxes.

Capital Gains Tax in Crypto

Cryptocurrencies have unique tax implications. In California, capital gains from crypto transactions are taxed. Understanding these rules helps minimize liabilities.

Taxation on Crypto Transactions

California treats cryptocurrencies as property. Capital gains tax applies when you sell or trade crypto assets. This is similar to how different tax rules apply to foreign currencies, such as the Saudi Arabia currency, in international transactions.

- Short-Term Crypto Gains

- Held for one year or less.

- Taxed as regular income.

- Rates vary by income bracket.

- Long-Term Crypto Gains

- Held for more than one year.

- Lower tax rates than short-term gains.

- Encourages long-term holding.

Current Crypto Tax Rates in California

|

Income Bracket |

Short-Term Rate |

Long-Term Rate |

|

Low Income |

1% |

0% |

|

Middle Income |

9.3% |

5.8% |

|

High Income |

12.3% |

9.3% |

Strategies to Minimize Crypto Tax Liabilities

- HODL Strategy: Hold assets for over a year to reduce the tax rate.

- Tax-Loss Harvesting: Sell underperforming assets to offset gains.

- Crypto IRAs: Invest in tax-deferred Crypto IRAs for growth.

Just like troubleshooting a USB device not recognized error requires identifying and resolving the issue, properly understanding your capital gains and tax strategies ensures you’re not missing out on potential savings.

Reporting Crypto Transactions

Accurate reporting is crucial, and using digital tools for note-taking and documentation, like those mentioned in this Goodnotes review, can help streamline the process of tracking financial transactions.

- Maintain Records: Keep transaction records.

- Use Form 8949: Report transactions.

- Include on Schedule D: Summarize gains and losses.

Reporting and Filing Requirements

Here’s a process of reporting and filing requirements:

- Determine Your Capital Gains

- Gather Necessary Documentation

- Complete Form 8949

- Transfer Information to Schedule D

- Fill Out Form 540 (California Residents)

- Review and File Your Tax Return

Important Forms and Deadlines

|

Form |

Description |

Deadline |

|

IRS Form 8949 |

Report sale and disposition of capital assets |

April 15th |

|

Schedule D (Form 1040) |

Summarize capital gains and losses |

April 15th |

|

Form 540 (California) |

Report capital gains to California |

April 15th |

|

Form 593 (California) |

Report real estate withholding |

April 15th |

Overview of Other Relevant California Taxes

Income Tax Rates

Here’s a summary of the income tax rates for 2025:

|

2025 |

Low Income |

1.1% |

|

2025 |

Middle Income |

9.4% |

|

2025 |

High Income |

12.4% |

Qualified Small Business Stock (QSBS)

Qualified Small Business Stock (QSBS) refers to shares issued by a small business. These shares can provide significant tax advantages to investors.

The stock must be held for at least five years to benefit from capital gains tax exemption. This incentive encourages investment in small businesses. It supports innovation and economic growth.

Property and Sales Tax Overview

In addition to income tax, California residents must also consider property and sales taxes. Property tax rates are typically around 1% of the property’s assessed value. While sales tax rates vary by county but generally range from 7.25% to 10.25%.

Detailed Look at Various Tax Types

California’s tax system includes various taxes that residents need to be aware of:

- Income Tax: Progressive rates based on income brackets

- Property Tax: Approximately 1% of assessed property value

- Sales Tax: Varies by county, typically between 7.25% and 10.25%

- Capital Gains Tax: As discussed in previous sections

Filing Deadlines for 2025

Being aware of the filing deadlines for 2025 is equally important for staying compliant and avoiding penalties:

|

Tax Type |

Deadline |

|

Income Tax |

April 15, 2025 |

|

Property Tax |

April 10, 2025 (First installment) |

|

Property Tax |

October 10, 2025 (Second installment) |

|

Sales Tax |

Quarterly (April 15, July 15, October 15, January 15) |

Tax Planning for Real Estate Investments

How to Minimize Taxes on Property Sales

Selling property can trigger significant taxing events. Use strategies like netting losses and understanding the net stock price to minimize liabilities. When selling a property or car wash for sale, the value of assets sold influences your short-term gains versus long-term capital gains.

Real Estate Stocks and Land Investment Strategies

Investing in real estate stocks and land stock may also trigger capital gains tax. To minimize exposure, you can plan your assets strategically by utilizing progressive stock price methods and calculating the short term impact of these sales on your capital gains tax.

Real Estate Transactions in California

Here are the proposed capital gains tax brackets for 2025:

|

Income Bracket |

Tax Rate |

|

Low Income |

1% |

|

Middle Income |

9.4% |

|

High Income |

12.4% |

Reporting Capital Gains for Real Estate

Complete Form 8949 and transfer the totals to Schedule D to report capital gains from real estate transactions.

Include this information on Form 540 and Form 593 for California residents. Accurate reporting ensures compliance with both federal and state capitals tax laws.

Transfer Taxes in California

California imposes transfer taxes on the sale of real estate. These taxes vary by county. Here are some sample rates:

|

County |

Transfer Tax Rate |

|

Los Angeles |

0.56% |

|

San Francisco |

0.75% |

|

San Diego |

0.60% |

Selling Inherited Property: Tax Considerations

When selling inherited property, the step-up in basis provision applies. This means the property’s basis is adjusted to its market value at the time of inheritance. This potentially reduces the capital gains tax owed upon sale.

Other Selling Expenses to Expect

Here are common expenses when selling a property:

- Real estate agent commissions

- Closing costs

- Repairs and renovations

- Staging and marketing expenses

Preparing for Real Estate Taxes

Follow these tips to prepare for real estate taxes:

- Maintain detailed records of all transactions and expenses.

- Consult with a tax professional to understand your obligations.

- Review current tax laws and proposed changes regularly.

Common Mistakes and Pitfalls in Capital Gains Tax Filing

Reporting Errors in Capital Gains Tax

Many investors make errors when reporting capital gains. Always check your realized and unrealized gains to ensure you’re not overreporting. Taxpayers often overlook losses, which can be used to offset gains through netting strategies.

Using a real estate calculator and understanding offset definition can clarify the tax filing process.

What to Do if You Overpaid Capital Gains Tax

If you paid too much in taxes, carry the excess forward or back using loss carryover methods. Understanding how cero stock may be considered in this process can help you file correctly. Also, consider how to talk to short people about their unique situations in the tax world—by clarifying tax positions.

Proposed Tax Increases and Their Effects

Biden’s proposed tax rates for 2025. It includes higher taxes on high-income earners and corporations. The plan aims to fund public services and reduce the deficit.

Key proposals include increasing the corporate tax rate to 28% and implementing a global minimum tax on multinational corporations.

Higher tax bills for high-income earners and businesses may reduce disposable income and increase consumer prices.

How to avoid paying on property? Moving out of California before selling a house or property. It can help avoid high state taxes but involves careful planning and consideration of various factors.

California Tax Audits

California tax audits ensure accurate reporting of income and deductions. The process involves reviewing tax returns, requesting additional documentation, and verifying reported information.

You will receive a written notification detailing the tax year and issues under review if you were selected for an audit.

Managing capital gains tax in California requires understanding current rates, exemptions, and filing requirements.

You can minimize tax liability and optimize your financial planning by staying informed and consulting with tax professionals.

FAQs

How do I avoid capital gains tax in California?

You can avoid capital gains tax through the Primary Residence Exclusion, a 1031 Exchange, maximizing cost basis, or timing the sale.

Do I have to pay capital gains tax in California if I sell my house?

Yes, unless you qualify for an exclusion like the Primary Residence Exclusion.

What is the 6-year rule for capital gains tax?

No specific "6-year rule," but you can exclude gains if you've lived in the home for 2 out of the last 5 years.

What taxes do I need to pay when selling a house in California?

Capital gains tax, withholding tax (3.33% of the sale price), and property taxes up to the sale date.

Does California offer any exemption on the capital gains tax?

Yes, the Primary Residence Exclusion allows you to exclude up to $250,000 ($500,000 for couples) in capital gains.